Over recent months, consumers have been piling on the debt at the highest rate since the start of the Great Recession more than 4 years ago. What does this mean for ARM professionals in search of increased placement volumes and improved liquidation results? Let’s find out.

First, let’s take a look at the big picture. Household debt, which consists of mortgages, credit cards, auto loans and student loans, rose 0.3% to $11.34 trillion in the fourth quarter of 2012—the first increase since the third quarter of 2008 according to a Federal Reserve Bank of New York report.

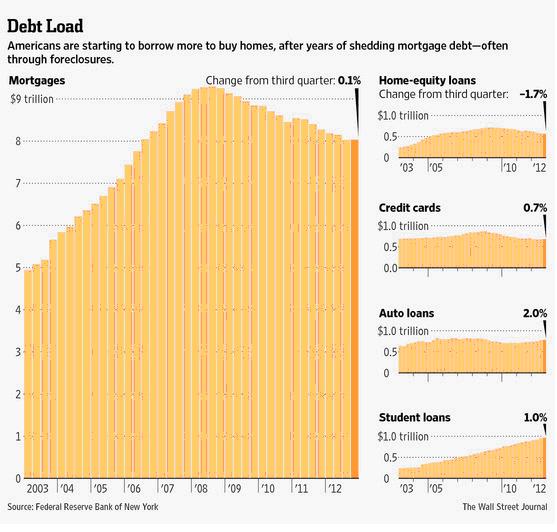

An illustration from the Wall Street Journal on the data shows how debt levels have fared by sector since 2003.

According to the Report, Americans borrowed $553 billion in new mortgages and far fewer consumers fell into foreclosure. After a long run of reductions, mortgage debt, the largest contributor to consumer debt and a strong indicator of economic improvement, is showing signs of bottoming out and is positioned to rise.

Outstanding auto loans, student loans and credit-card balances also increased $15 billion, $10 billion and $5 billion, respectively. For all of 2012, auto-loan balances rose $50 billion, or 7%.

Overall, however, American consumers are still not carrying as much debt as they did prior to the Great Recession. Debt levels remain $1.3 trillion below their peak of $12.7 trillion in the third quarter of 2008—and $200 billion below their level in the fourth quarter of 2011. Credit-card balances also fell 4%, or $25 billion, throughout 2012, as many consumers remain focused on paying off loans and are spending less. This is true for most market segments except for one, student loans, where borrowings and default rates are spiking to new highs.

Student loans outstanding hit $966 billion at the end of last year, from nearly $400 billion in 2005. The percentage of student loans that were delinquent by 90 or more days continued to increase in the fourth quarter of last year to 11.7% from 11%. 35% of student-loan borrowers under 30 were at least 90 days late on their payments at the end of 2012, up from 26% in 2008 and 21% in 2004.

Student loans have become an important barometer. Borrowers who are behind on their student loan payments are much more likely to also be delinquent on auto-loan, credit-card and mortgage payments.

The lead indicator for improved collection results is still the unemployment rate. The Federal unemployment rate of 7.8% in December 2012 was down from the 8.5% rate in December 2011, a strong sign that the economy is on the right track. However, we are not out of the woods yet. A 160,000 increase in payroll employment in January 2013 is not enough to significantly reduce the unemployment rate. When consumers feel good about their employment status they feel better about spending and paying down debt obligations.

On a personal note, my heartfelt condolences to the family and friends of Pat Carroll who passed away last Saturday. I first met Pat at Payco American nearly 20 years ago. Pat was always available to speak to me about the industry and he possessed an uncanny ability to put important matters into proper perspective. Pat left us too early. He will be missed.

![Photo of Mike Ginsberg [Image by creator from ]](/media/images/2017-11-mike-ginsberg.2e16d0ba.fill-500x500.png)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)