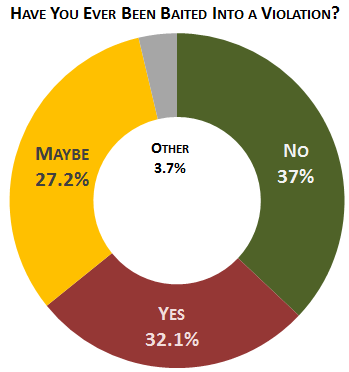

In an unscientific poll question posted on insideARM.com last week, 59.3 percent of ARM firm respondents reported that they have or may have been baited into a violation of collection law by a consumer.

The poll was prompted, in part, by a piece we ran a couple of weeks ago from Maurice & Needleman attorney Thomas Dominczyk: “Consumer Baits Collector to Violate FDCPA, Files Suit.” Of course, the other part was that we have been hearing from debt collectors for years that they feel there are consumers that actively solicit collection law violations, mainly of the FDCPA.

Rather than conducting a full survey with myriad possibilities and variables, we asked one fairly direct question with only three possible answers: Have You Ever Been Baited Into a Violation?

The most common single response was “Not that we know of” at 37 percent.

The most common single response was “Not that we know of” at 37 percent.

But another 32.1 percent of respondents noted that “Yes, the truth came out.” We also allowed for borderline cases where the ARM firm felt that it may have been the target of a baiting scheme. Just over 27 percent of respondents answered “Maybe. There was that one time…”

The remainder of the responses fell into the “Other” category, where participants were offered the chance to explain further in their own words. Truthfully, only one of those responses was helpful in any way. “Baited, but no violation,” wrote one insideARM reader. And that, perhaps, was an answer we should have considered including in the poll. (the other responses were either nonsensical or trolling attempts by consumers or consumer advocates)

This is obviously a major issue for collection agencies that handle moderate to large volumes of consumer contacts. Truthfully, we were a little surprised that so many companies felt that had or may have been baited into violations.

Training is critical to ensuring collectors do not fall into traps while on the phones with consumers. Check out insideARM’s Compliance products in our Research Library to see if anything can be of use to your organization. And let us know if you see a gap in our offerings.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)