The U.S. Department of Education held a very important meeting Wednesday for its debt collection vendors (and potential vendors). The long, and at some points unnecessarily acronym-laden, meeting included some very important information for any collection agency looking for ED dollars. Patrick Lunsford and Mike Bevel took the bullet for readers and report thusly:

The 8.30 a.m. ED PCA (Private Collection Agency) Meeting began at 9.00 a.m. with a roomful of people introducing themselves. “I’ll give you $15,” I told Patrick Lunsford, “if you belt out Christopher Cross’s ‘Sailing‘ when they hand you the microphone.”

He declined.

(And can we talk for, like, two minutes about that video? Because I don’t know about you, but I keep a running list of people I would never expect to see in a football jersey in the back of my mind, next to my list of favorite “Murder, She Wrote” special guest stars and the fact that Rainn Wilson was in an episode of “Charmed” in a very unflattering caftan-like satin shirt because someone apparently carries low, and I had no idea that I would need to make room for Christopher Cross on that “never expected to see him in a football jersey” list until moments ago.)

We were gathered in an auditorium of the Department of Education building in downtown D.C. (oh, and remind me to tell you about the woman fake-smoking a real cigarette in front of the Starbucks that was somehow weirder than the homeless man rearranging all the outdoor furniture) to hear the presentation on the state of federal student loans and what participating collection agencies — and their sub-contractors — can look forward to next year with the new contract.

Open-mic comedy hopeful Dwight Vigna, Director of the agency’s Default Division, opened with the division’s two goals:

- Be respectful to our borrowers and find the best solution that will resolve the borrower’s debt regardless of the commission being paid.

- Increase the FSA overall collection rate on a year to year basis even though the inventory is also increasing annually.

As of September, the size of ED’s default portfolio is $33,502,777,441, made up of roughly 3 million borrowers and 15 million active loans.

The recovery rate among collection agencies is just shy of 11.5 percent — and that’s the number targeted in Goal 2 above. ED would like to bump that to 13.86 percent in 2012 and grow it to just about 14 percent in 2015. (Provided, of course, that we’re all still here.)

And how much money is at stake for approved collection agencies? The commission pool in 2012 is $500 million and is projected to reach $700 million in 2015.

So how does a debt collection agency get in on that sweet, sweet action? Well, there’s a new contract coming up. And that was really the entire point of the meeting in the first place.

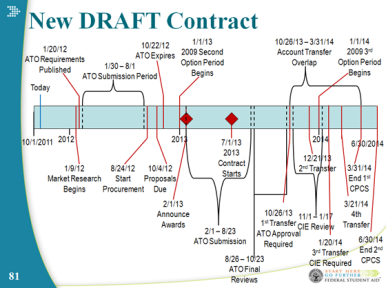

The current contract — called the 2009 contract, but really it was the 2008 contract until it got delayed by…stuff – is due to expire at the end of 2012. But ED will be taking extension options that will keep it going through the second quarter of 2014. After that, it’s over. So a new contract will need to be in place.

According to the draft contract deadline – and trust us, ED wants to emphasize the DRAFT part – the official procurement process will begin in August 2012. ED will begin their market research in January of next year and should be ready with the official RFPs/RFQs and other documents by August. Early October 2012 is the tentative deadline for bids from qualified collection agencies. After that, awards are expected to be announced in February 2013 and accounts will start flowing later that year, with an appropriate overlap between the two contracts.

Although the crowd pushed it, ED would not commit to a total number of collection agencies that would be on the new contract. With ED’s portfolio growing by the day, it would seem to follow that more than the current 22 agencies would be on the contract. But the department has launched a fancy new sub-contracting program that is designed to give more opportunity to small businesses (more on that in a bit).

Agencies seeking the ED debt collection contract would be well-advised to start planning now. The data security requirements alone can prove too high a hurdle to leap for many companies (and that was discussed at length in the meeting as ED is converting to a new computer system and all collection agencies are required to get re-authorized). But the payoff is extraordinary.

For ARM companies that do not wish to go through the full procurement process, ED has a new formal sub-contracting program. Tasked with the directive of including more small businesses in collection work, Vigna said that his group decided sub-contracting would be the best path to follow.

Beginning with the current performance score reporting period (essentially the fourth quarter of 2011), collection agencies on the contract have the opportunity to score additional points by subcontracting out some of their portfolio. The agencies are not required to subcontract, but total performance scores determine future levels of account placements, so there is good incentive to do so. Agencies that forward 10 percent or more of their accounts to a small business subcontractor will receive five additional points (out of a possible total of 100).

To keep everything on the up-and-up, ED requires that a random sample of accounts be forwarded so that agencies on the contract don’t cherry-pick the best accounts and leave the rest to their subcontractors. Accounts must be transferred within 10 business days of receiving them from ED and they must stay with the subcontractor for at least four months.

There was also much discussion about ED’s computer system conversion, but honestly, we couldn’t follow any of it. Summary: things are going about as well as any system conversion goes (read: not awesomely), and people don’t particularly like the process, but it will be a better system so deal with it already. At least, we think that’s what was happening.

Oh, and if you’re ever in DC for an ED meeting, the restaurant in the Holiday Inn across the street has pretty good steak fries and panini.

![Photo of Mike Bevel [Image by creator from ]](/media/images/15313207355886984574190085724020.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)