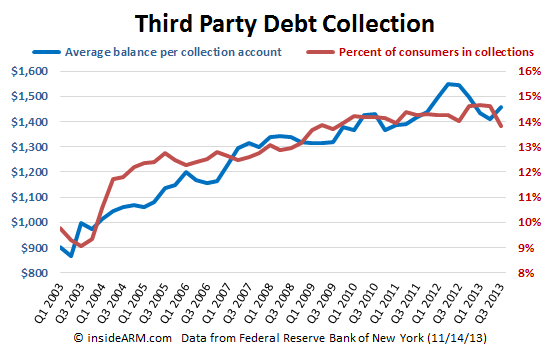

The percentage of American consumers with at least one account in the third party debt collection system fell sharply in the third quarter of 2013, according to data released Thursday by the Federal Reserve Bank of New York (FRBNY).

In its Quarterly Report on Household Debt and Credit, the FRBNY reported that percentage of U.S. consumers with at least one account in collections fell to 13.8 percent last quarter. In the second quarter of 2013, the same measure read 14.6 percent. It was the largest quarter-over-quarter decline since the group started tracking the metric in 1999.

The FRBNY’s report is compiled using a sample of Equifax credit reports which results in “a unique longitudinal quarterly panel of individuals and households.” The panel is a nationally representative 5% random sample of all individuals with a social security number and a credit report (usually aged 19 and over).

While the percentage of consumers with accounts in the third party debt collection system fell in the third quarter, the average account balance in collection jumped to $1,458 from $1,409 in the second quarter of 2013. The average balance of collection accounts had been declining over the previous five quarters.

The drop in the number of collection accounts coupled with the rise in average balance most likely indicates that many consumers paid down smaller accounts in collection in the quarter, leaving higher-balance accounts to be included in the data.

New York Fed noted that its collection data includes both public record and account level third party collections information, and that only a small proportion of collections are related to credit accounts, with the majority of collection actions being associated with medical bills and utility bills.

Overall, the FRBNY report showed that outstanding household debt in Q3 2013 increased $127 billion from the previous quarter, the largest increase since the first quarter of 2008. The increase was due to rises in mortgage balances ($56 billion), student loans ($33 billion), auto loans ($31 billion) and credit card debt ($4 billion).

In Q3 2013 total household indebtedness increased to $11.28 trillion; 1.1 percent higher than the previous quarter. Overall consumer debt remains 11 percent below the peak of $12.68 trillion in Q3 2008.

“This quarter, we observed an increase of household balances across essentially all types of debt,” said Donghoon Lee, senior research economist at the New York Fed. “With non-housing debt consistently increasing and the factors pushing down mortgage balances waning, it appears that households have crossed a turning point in the deleveraging cycle.”

The percent of 90+ day delinquent balance for all household debt declined to 5.3 percent, the lowest rate since Q3 2008. Additionally, most household debt delinquency rates declined from the second quarter: mortgages (4.3 percent from 4.9 percent), credit card debt (9.4 percent from 10 percent) and auto loans (3.4 percent from 3.6 percent). Conversely, 90+ day delinquency rates for HELOC (3.5 from 3 percent) and student loans (11.8 percent from 10.9 percent) increased from the previous quarter.

Other highlights from the report include:

- Student loan balances appearing on credit reports increased $33 billion to $1.03 trillion.

- Auto loan balances increased for the 10 straight quarter, up $31 billion to $845 billion.

- Credit card balances increased $4 billion to $672 billion.

- Total mortgage debt increased to $7.9 trillion, up $56 billion.

- HELOC balances fell $5 billion to $535 billion.

- Mortgage originations dropped slightly to $549 billion.

- 168,000 individuals had new foreclosure notations added to their credit reports, 70 percent below the peak of 566,000 in Q2 2009.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)