The number of lawsuits filed against accounts receivable management firms claiming violations of the Fair Debt Collection Practices Act (FDCPA) fell in the first half of August following a broad trend of declines in FDCPA suits in 2012 compared to 2011.

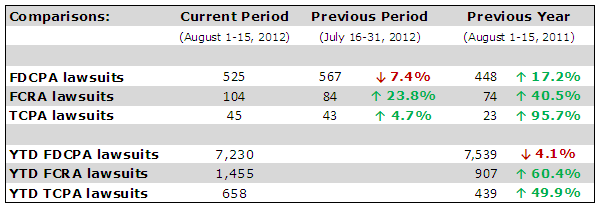

From August 1 to August 15, 2012, suits filed by consumers claiming violations of the FDCPA fell 7.4 percent percent compared to the previous period (the second half of July).

FDCPA lawsuits are down more than 4 percent in 2012 compared to the same point in 2011. But if there is any trend in year-over-year FDCPA suits, it’s one of a narrowing gap.

“Two months ago, the difference in FDCPA lawsuits in 2011 and 2012 was 3.2%,” said Jack Gordon, CEO of WebRecon, LLC. “Six weeks ago it spiked to 6.7%, four weeks ago it was 7%, two weeks ago it was 5.4%, and now it is 4.1%.”

Even with a narrowing gap, the recent growth trend in year-over-year FDPCA filings appears to have slowed. And consumers and their attorney representatives have been focusing on other statutes.

Lawsuits claiming violations of the Fair Credit Reporting Act (FCRA) are up 60 percent over this time in 2011 and Telephone Consumer Protection Act (TCPA) suits have increased nearly 50 percent.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)