Experian released findings today on the credit card and mortgage payment behaviors* of consumers both nationally and in the top 30 Metropolitan Statistical Areas (MSAs). Nationally, since 2007, 20 percent fewer credit card payments are 60 days late, but 25 percent more consumers are paying their mortgage 60 days late.

The cities that showed the most improvements to bankcard payments include Cleveland, Ohio; San Antonio, Texas; Cincinnati, Ohio; Dallas, Texas; and Houston, Texas. Cities that have made the least improvements to their credit card payments include Riverside, Calif.; Seattle, Wash.; Tampa, Fla.; Phoenix, Ariz.; and Miami, Fla. Additionally, the data shows only four cities that improved in making mortgage payments: Cleveland, Ohio; Minneapolis, Minn.; Denver, Colo.; and Detroit, Mich.

The charts below show the percentage of change from 2007 through 2011. The first chart below ranks the top 30 cities from the most improved bankcard payments to the least improved and the second chart represents the percentage of change in late mortgage payments.

| MSA | Percentage change in improved bankcard payments (best to worst) |

|

| 1. | Cleveland | 34.7% |

| 2. | San Antonio | 30.5% |

| 3. | Cincinnati | 30.0% |

| 4. | Dallas | 28.8% |

| 5. | Houston | 28.6% |

| 6. | Boston | 27.7% |

| 7. | Detroit | 26.7% |

| 8. | Sacramento | 25.4% |

| 9. | Philadelphia | 24.9% |

| 10. | St. Louis | 23.8% |

| 11. | Kansas City | 23.2% |

| 12. | Pittsburgh | 23.1% |

| 13. | San Francisco | 22.3% |

| 14. | Atlanta | 21.8% |

| 15. | Baltimore | 20.9% |

| 16. | Denver | 20.4% |

| 17. | Minneapolis | 19.7% |

| 18. | Los Angeles | 19.1% |

| 19. | New York | 18.2% |

| 20. | Washington DC | 16.8% |

| 21. | Portland | 15.7% |

| 22. | San Diego | 15.3% |

| 23. | Chicago | 15.1% |

| 24. | Orlando | 13.3% |

| 25. | Las Vegas | 12.7% |

| 26. | Riverside | 9.4% |

| 27. | Seattle | 8.0% |

| 28. | Tampa | 5.3% |

| 29. | Phoenix | 2.4% |

| 30. | Miami | 1.4% |

| MSA | Percentage change in missed mortgage payments (worst to best) |

|

| 1. | Portland | 99.9% |

| 2. | Phoenix | 78.4% |

| 3. | Baltimore | 66.8% |

| 4. | Seattle | 65.1% |

| 5. | New York | 49.4% |

| 6. | Philadelphia | 48.0% |

| 7. | Orlando | 44.3% |

| 8. | San Francisco | 43.0% |

| 9. | Los Angeles | 36.3% |

| 10. | Chicago | 31.2% |

| 11. | Washington DC | 31.1% |

| 12. | Tampa | 30.9% |

| 13. | Riverside | 29.7% |

| 14. | Las Vegas | 29.5% |

| 15. | Atlanta | 23.5% |

| 16. | San Antonio | 21.4% |

| 17. | Miami | 21.2% |

| 18. | Kansas City | 19.2% |

| 19. | Boston | 16.5% |

| 20. | Pittsburgh | 16.3% |

| 21. | Houston | 16.1% |

| 22. | San Diego | 11.1% |

| 23. | Dallas | 10.8% |

| 24. | Sacramento | 8.9% |

| 25. | Cincinnati | 3.0% |

| 26. | St. Louis | 1.0% |

| 27. | Cleveland | -3.8% |

| 28. | Minneapolis | -5.9% |

| 29. | Denver | -7.4% |

| 30. | Detroit | -17.1% |

“In looking at the numbers, we’re seeing that even in the cities at the bottom of the list, consumers are meeting their bankcard payment obligations better than before the recession,” said Michele Raneri, vice president of analytics, Experian. “While the Experian data shows an overall improvement to these 60 day delinquencies, as much as a 30 percent improvement is seen in the key Texas cities, which is a positive sign in what has been a slow economic recovery.”

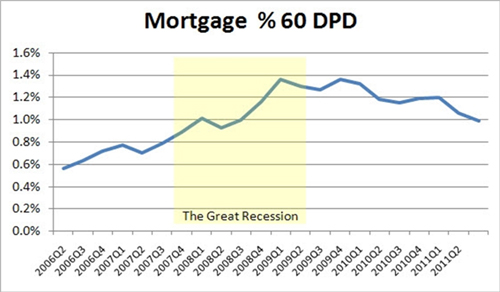

The following charts provide a view into the bankcard and mortgage change patterns since Q1 2006 through Q2 2011:

While the trend is positive on the bankcard side, the mortgage side is continuing to suffer in most of the markets. Delinquent payments and collections can have a major negative impact on a credit score and a consumer’s ability to obtain credit. Below are some tips for consumers to consider regarding payment behavior:

- Make sure your payments are current, and do not let them be late again. The longer your history of on-time payments, the less impact the delinquencies will have on your creditworthiness.

- If you miss a payment on an individual account, that payment may impact your ability to open joint accounts because both credit histories will be considered.

Experian is the leading global information services company, providing data and analytical tools to clients in more than 80 countries. The company helps businesses to manage credit risk, prevent fraud, target marketing offers and automate decision making. Experian also helps individuals to check their credit report and credit score and protect against identity theft. www.experianplc.com

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)