Ah, I love the smell of flowers and profits in the morning! It’s the beginning of spring, and that means the height of the tax season: the period of time in which most ARM companies experience their best performance of the year. This is also the time when buyers are actively buzzing around the ARM industry in search of ideal acquisitions. So, why not consider taking a call or two and see if the timing is right to sell your business?

Ah, I love the smell of flowers and profits in the morning! It’s the beginning of spring, and that means the height of the tax season: the period of time in which most ARM companies experience their best performance of the year. This is also the time when buyers are actively buzzing around the ARM industry in search of ideal acquisitions. So, why not consider taking a call or two and see if the timing is right to sell your business?

While the treasure at the end of the rainbow may seem extremely appealing, unfortunately a lot more goes into selling a company these days than just sending out some information, having a few conversations, and hashing out a legal document. Before you start walking down the primrose path with one or more prospective buyers, you should consider the following questions and determine if the timing is right for you:

- What is the value of my business in today’s market?

- How much money do I need in order to sell my business?

- What type of buyer makes the most sense for my business?

- What information do I need to share with buyer prospects?

- Whom do I need within and outside of my company to help me sell my business?

- How long am I willing to remain involved post-transaction?

I will address the first question below, and follow up with consecutive weekly blogs to address the other five questions.

What is the value of my business in today’s market?

Determining the value of a business is much more of an art than a science. It depends on what type of company you have and how valuable it is to a specific buyer. Traditionally, buyers have determined enterprise value for ARM servicing companies (first- and third-party collection agencies and debt collection law firms) based on either a multiple of Seller’s Discretionary Earnings (SDE) or a multiple of adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) either over the preceding twelve months or in the most recent fiscal year period. The multiple of SDE approach is typically used for smaller businesses in which the owner(s) is active and most or all of the value is paid out to the owner each year in the form of compensation and benefits.

For larger companies, the multiple of adjusted EBITDA approach is more common. If you have financial statements, you can quickly determine your company’s EBITDA by taking the Net Income and adding to it the amount showing for Interest Expense, Income Taxes, Depreciation Expense and Amortization Expense. Once you know the EBITDA amount, you can then adjust it by adding the list of owner expenses that will not exist post-transaction, as well as any non-recurring or one-off expenses that occurred. In some cases you may need to make one or more negative adjustments if your business needs to fill a key executive position or if it had to bear additional expenses that were not factored into the financial results. If you do not have financial statements, ask your accountant or bookkeeper to provide you with these numbers from your tax return results.

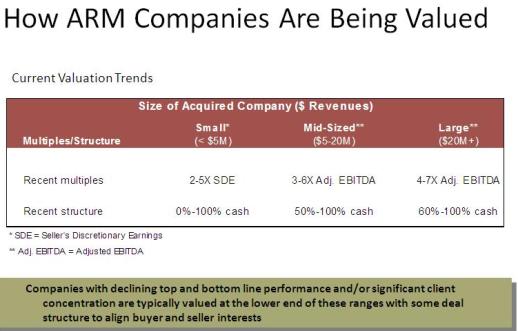

The following chart shows the range of adjusted EBITDA multiples for ARM servicing companies over the past couple of years:

As you can see in the row labeled “Recent multiples,” the ranges are quite wide for each size category. This reflects the diversity of ARM businesses that fall into each category, and their differences in financial performance, growth potential, lists of clients and prospects, competitive advantages, existing legal and regulatory issues, etc. To learn how buyers would value your business in today’s market, it may be helpful to hire a valuation expert who understands your industry well and has experience completing M&A transactions within it. Valuation experts can also point out certain issues that your company may have currently. If corrected, this could improve your enterprise value by raising the multiple that buyers are willing to pay or by improving the adjusted EBITDA results.

You will also notice in the row below labeled “Recent structure” that the enterprise value amount may not be paid entirely in cash at closing. Over the past couple of years, most transactions have involved some form of deal structure, including escrow amounts, earn-outs, retained equity, and seller’s notes. We will further discuss the different forms of deal structure in next week’s blog.

During the high growth years (2002 to 2006), debt purchasing companies were trading on multiples of adjusted EBITDA as well. However, toward the end of this period, most buyers shied away from this approach due to the increased level of pricing and uncertainty surrounding the future performance of the debt purchasing companies. The valuation methodology switched to a discounted cash flow (DCF) analysis, which is used to calculate the net present value of the future cash flow streams from portfolios under management. In certain cases, buyers were willing to pay a premium above the net present value amount to reflect additional value in the platform, proprietary data, liquidation strategies, and portfolio scoring methodologies that would be part of the transaction.

With the M&A activity picking up over the past year, more buyers are actively looking for the right companies to acquire. While this makes for an attractive time to consider the sale of your business, it is very important for you to understand what your company may be worth in today’s market before you entertain discussions with prospective buyers.

Next week I will address perhaps the most important question that owners must answer before signing a sale agreement… How much money do I need in order to sell my business? I will delve more deeply into how deals are being structured so you can better understand the distinction between terms like “enterprise value” and “cash at closing” in a transaction. I will also provide some tips on how to determine this amount so you can decide whether or not a sale will achieve your desired results.

Mark Russell manages M&A transactions as Director for Kaulkin Ginsberg. To confidentially discuss your business interests, please contact Mark Russell at 240-499-3804, or by email

Mark Russell manages M&A transactions as Director for Kaulkin Ginsberg. To confidentially discuss your business interests, please contact Mark Russell at 240-499-3804, or by email

![Photo of Mark Russell [Image by creator from ]](/media/images/Mark_Russell.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)