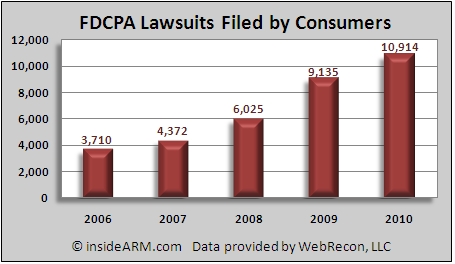

Consumers filed more lawsuits in 2010 against ARM companies alleging violations of the Fair Debt Collection Practices Act (FDCPA) than in any other year, according to data released Tuesday.

For the full year, 10,914 lawsuits seeking relief under the FDCPA were filed by or on behalf of consumers. The total marks a 19.5 percent increase in suits from 2009.

According to the data released by WebRecon, LLC — a firm that tracks consumer lawsuits against ARM companies — since 2006, FDCPA lawsuits have increased 194 percent.

FDCPA lawsuits were not the only type that saw an increase in 2010. There were almost 1,300 suits alleging violations of the Fair Credit Reporting Act (FCRA), up from 1,174 in 2009.

The rapid increase in consumer lawsuits against ARM companies has prompted internal debate among leaders as to the cause of the rise. Many acknowledge that increased collection call volumes and aggressive tactics in a down economy have led to more violations.

But consumers, and the plaintiff attorneys that represent them, are also becoming increasingly aggressive in identifying potential violations, no matter how small. According to data released to insideARM.com under a Freedom of Information Act (FOIA) request, from 2007 to 2009, the complaint category that saw the largest increase was for violations of the so-called “mini-Miranda” disclosure requirement. Over that time period, mini-Miranda violation complaints increased 1,612.5 percent.

Consumers can become addicted to FDCPA suits if they are successful. The lure of a quick settlement for thousands of dollars brings many plaintiffs back for more. According to a LexisNexis analysis of court filings, 18 percent of FDCPA lawsuits are filed by plaintiffs who had previously filed a similar lawsuit.

The increased demand is causing some consumer attorneys to overstep their bounds. Last year, the state of Minnesota suspended one consumer attorney for failure to disclose his client’s death during settlement negotiations (“FDCPA Plaintiff Attorney Suspended from Practicing Law by State,” July 2, 2010).

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![[Image by creator from ]](/media/images/Thumbnail_Background_Packet.max-80x80_af3C2hg.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)