That’s a pretty good question. Fortunately, there is an answer: Winneshiek County, Iowa.

In its Quarterly Report on Household Debt and Credit for the fourth quarter of 2011, the Federal Reserve Bank of New York drilled down on consumer indebtedness by county and by asset class. While the results took a little while to compile, the data offer a fascinating glimpse of how different geographic economic conditions influence payment behavior. (as a side note, the FRBNY’s quarterly consumer credit data is excellent. You should check it out.)

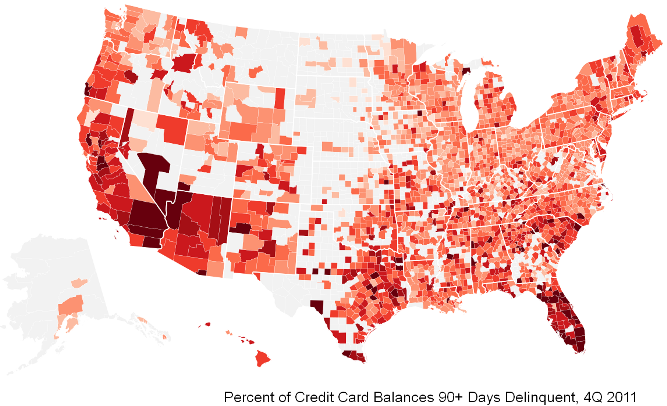

For example, one of the metrics the FRBNY highlighted was delinquency of total credit card balances (not number of accounts delinquent). For this, they used the 90+ days delinquent benchmark and randomly sampled consumers in counties with borrowing populations above 10,000. The results were fairly predictable: counties with very high foreclosure rates (like those in the Las Vegas, Riverside (CA), and South Florida areas) were more likely to have consumers severely behind on other debt types, including credit cards.

The outlier is Winneshiek County, Iowa, with the highest credit card balance delinquency rate. The county is not experiencing high delinquency rates for mortgages or auto loans, but for whatever reason, credit card balances are more delinquent there than in any other county in the U.S., a whopping 50 percent!

Upon analysis of the numbers, we honestly feel that the result is a data entry error, and the county’s true delinquency rate is around 5 percent. This would move Sumter County, Ala. into first place with a 25.29 percent 90+ day credit card balance delinquency rate, which is much more in line with the county’s previous quarterly rates and delinquency rates in other asset classes.

Click on the image below to launch an interactive map of the FRBNY results. The darker the red color, the higher percentage of credit card delinquencies. Areas in gray did not have populations large enough to qualify for the study.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)