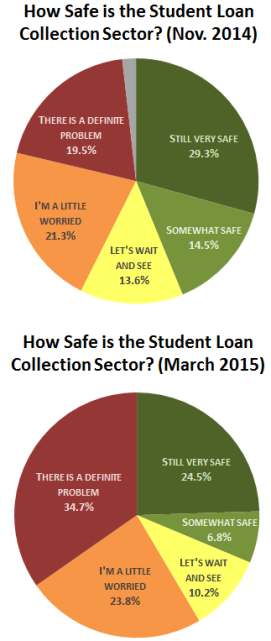

insideARM.com readers are growing increasingly nervous regarding the safety of the student loan debt collection market, according to two polls conducted over the past five months. Asking the exact same question at different times, respondents indicated that recent developments are driving the pessimism.

Last November, insideARM asked readers a very straightforward question: How Safe is the Student Loan Sector?

Of particular interest at the time was the news that the U.S. Treasury Department is readying a pilot program to take over the collection of some defaulted student loan accounts from the Department of Education, essentially removing the work from contracted private debt collection agencies. And there were recent developments in regulation, with the CFPB taking a very hard look at student loan debt collections.

On the other side of the equation, ED had just announced contract awards for small business vendors on its student loan debt collection contract representing an expansion of that particular contract. So there was some good news.

Opinion was spread somewhat evenly on a continuum of optimistic to pessimistic.

Two weeks ago, in light of more substantial developments, we asked the exact same question again.

Since the original poll, ED ended its contracts with five collectors, the protest of that decision has moved to the courts, and President Obama announced a Student Aid Bill of Rights, some provisions of which directly address student loan debt collection.

The difference in the two poll results is quite noticeable.

Late last year, nearly 45 percent of respondents had an optimistic outlook on the safety of the market, mostly due to overwhelming volume of accounts. That is, of course, no small consideration. Student lending is growing at an astronomical rate in the U.S. and default rates are very high.

Late last year, nearly 45 percent of respondents had an optimistic outlook on the safety of the market, mostly due to overwhelming volume of accounts. That is, of course, no small consideration. Student lending is growing at an astronomical rate in the U.S. and default rates are very high.

Another 41 percent expressed some pessimism, with the remainder taking a wait-and-see position.

But earlier this month, the numbers had shifted significantly.

In the most recent poll, just over 30 percent of respondents expressed optimism while 58.5 percent fell into the pessimistic camp. There were also fewer wait-and-see responses.

It is important to note that many expressing strong pessimism are doing so from outside of the market. The most cautious answer option given specifically read “This is a definite problem and I would not invest in student loan infrastructure.” Student loan debt collection requires significant upfront investment, especially in the areas of systems and compliance processes. For many not currently in the market, those barriers might seem too high given recent uncertainty.

But for those already specializing in education recovery, many of the concerns are unlikely to change minds. There will always be a need for private student loan collectors regardless of developments at ED or even with the Treasury Department’s impending pilot to bring some accounts in-house.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)